Introduction

Overview

In October of 2014, the W3C chartered the Web Payments Interest group with the goal of providing a forum for Web Payments technical discussions to identify use cases and requirements for existing and/or new specifications to ease payments on the Web, and to establish a common ground for organizations providing payment services on the Web Platform. The overall objective of this group is to identify and help create the conditions for greater uptake and wider use of Web Payments through the identification of standardization needs to increase interoperability between the different stakeholders and the different payment methods.

The Web Payments Interest Group's scope covers payment transactions using Web technologies on all computer devices (desktop, laptop, mobile, tablet, etc.) running a Web user-agent (a Web browser, a hybrid app, or an installed Web application) and using all possible legal payments methods across a variety of scenarios including Web-mediated Business-to-Consumer (B2C), Business-to-Business (B2B), Business-to-Business to Consumer (B2B2C), and Person-to-Person (P2P) transactions in the case of physical (payment at physical shops) and online payments for physical or digital goods, including in-app payments.

Due to the fundamental importance of payments to the web and the intricate relationship with other core aspects of the open web platform such as identity and commerce, the Web Payments IG created this document with the following goals in mind:

- Provide a common place to capture and document key capabilities that are necessary for payments on the web

- Communcate important architectural principles related to payments on the web and how they relate to other standards such as identity and commerce

- Increasing visibility and improving coordination of various payments and related standardization efforts within the W3C Interest, Working, and Community groups and other standards bodies

Audience of this document

This document is intended to broadly inform discussions on standardization of key capabilities and high level architecture of payments on the web. The intended audience for this document includes:

- Participants in W3C Activities

- Other groups and individuals designing technologies to be integrated into the Web

- Implementers of W3C specifications

- Web content authors and publishers

Scope of this document

This document presents the general capabilities and architecture of payments on the Web and is one part of a greater body of work around Web Payments

that the W3C is producing. These other documents include:

Web Payments Interest Group Documents

-

A Vision for Web

Payments describes the desirable properties of a Web Payments

architecture.

-

Web Payments

Use Cases 1.0 is a prioritized list of all Web Payments scenarios

that the Web Payments Interest Group expects the architecture to

address in time.

-

Web Payments Capabilities 1.0 (this document) derives a set of

capabilities from the use cases that, if standardized, will improve

payments on the Web.

-

Web Payments Roadmap

1.0 proposes an implementation and deployment plan that will

result in enhancements to the Open Web Platform that will achieve the

scenarios outlined in the Use Cases document and the capabilities

listed in the Capabilities document.

Web Payments Community Group Documents

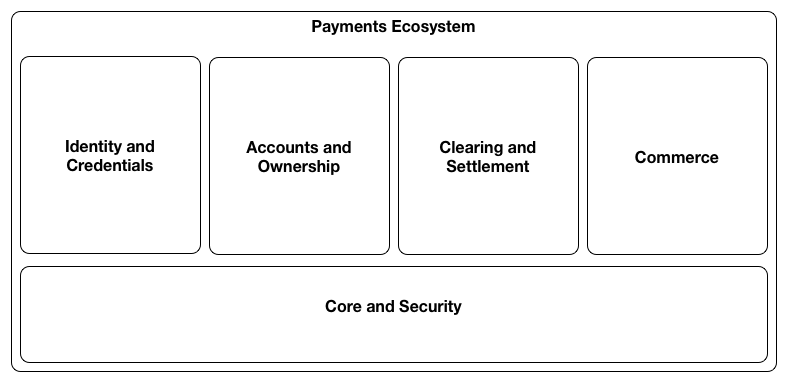

Capability Domains

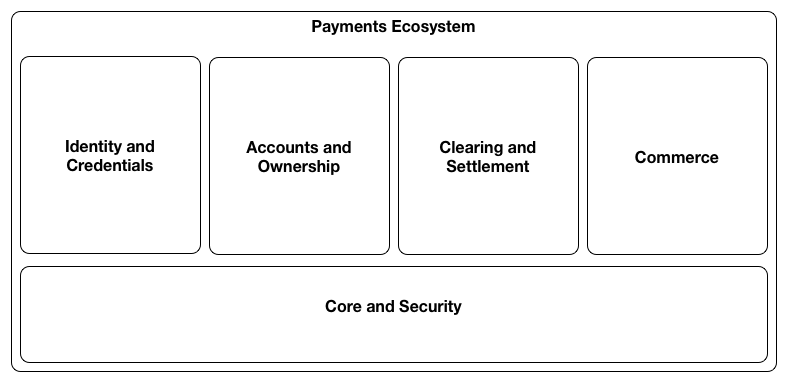

In order to illustrate core aspects of payments on the web, this section of the document is organized by functional capability domains. This is intended to help highlight specific areas that are needed for standardization of payments, and also to help communicate relationships and dependencies to adjacent standards work such as Identity and Commercial aspects of the web.

The capabilities have been organized into course grained domains which were structured to help promote consistent and cohesive concepts in similar functional aspects, reduce coupling between core payments standards and those which are useful more broadly than payments, and to minimize redundant or overlapping work being done on standards in this space by providing visbility into cross cutting concerns and topics across each functional domain.

Each capability includes backgound context specific to its domain, key goals and architecural principles related to the capability and outlines significant relationships with other standards work and capability domains. The five top level capability domains are represented in the diagram below:

Core and Security

These capabilities provide the

security foundation for payments.

Capabilities: Key Creation and Management,

Cryptographic Signatures, Encryption

Right now this group has only security capabilities in it. We may

wish to have a more general purpose Core set. If so, what would this

core set include?

Identity and Credentials

Includes features related to

establishing trust among parties, and credentialing or authorization

of parties involved in a transaction.

Capabilities: Identity, Credentials, Rights,

Authentication, Authorization, Privacy, Discovery, Registration,

Enrollment, and Legal/Regulatory concerns.

Accounts and Ownership

Includes capabilities

related to managing stores of value (such as Deposit Accounts) and

recorded accounts of ownership (such as Ledger entries, Deeds, etc.)

used as part of the settlement of payments or commercial exchanges.

Settlement via the Web involves access to the accounts of the

participants and ledgers of the account

providers and capabilities to manage accounts and capture and

monitor transactions in a ledger against those accounts.

Capabilities: Accounts, Account Management and Legal/Regulatory concerns related to accounts and recorded ownership

Clearing and Settlement

These are the capabilities

that help parties in a transaction establish the mechanics of how the

payment will be executed and the directly or indirectly make this

happen. This involves the ability to discover and negotiate the

mechanism that will be used to execute the payment and agree on the

terms including facts such as the costs of making the payment, time

between clearing of the payment and settlement into the payee's

account, regulatory requirements and required authorisations.

Capabilities: Messaging, Clearing, Markets, Foreign/Currency Exchange, and Legal/regulatory concerns specific to payment clearing, settlement and Exchange of Value.

Commerce

Includes capabilities related to

commercial and economic interactions.

Capabilities: Offers, Invoicing, Receipts, Loyalty,

Rewards, Contracts, Lending, Insurance, Taxation, Legal/Regulatory

concerns related to aspects of commercial and economic interactions.

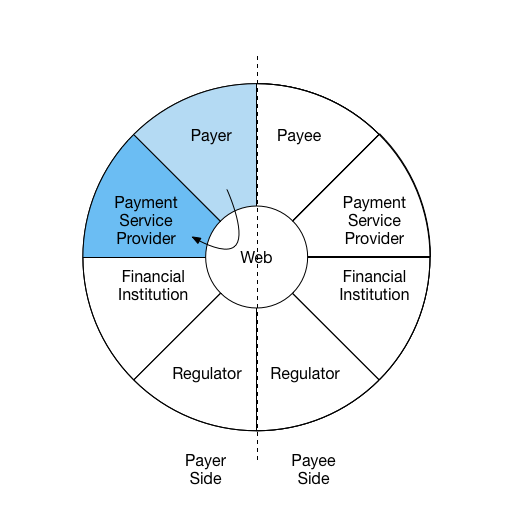

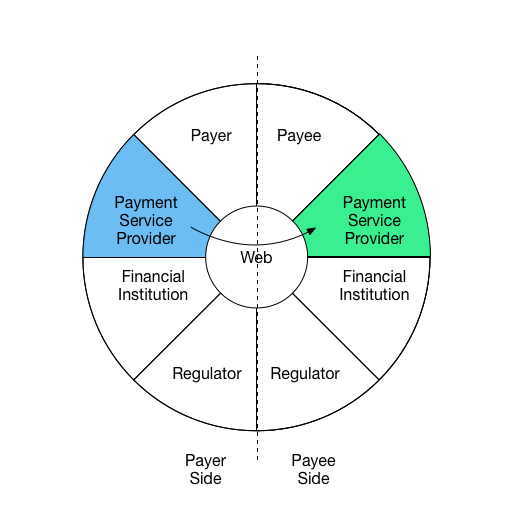

Capabilities in Context

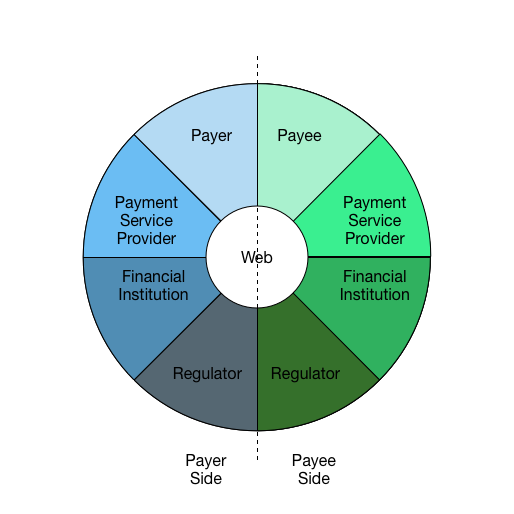

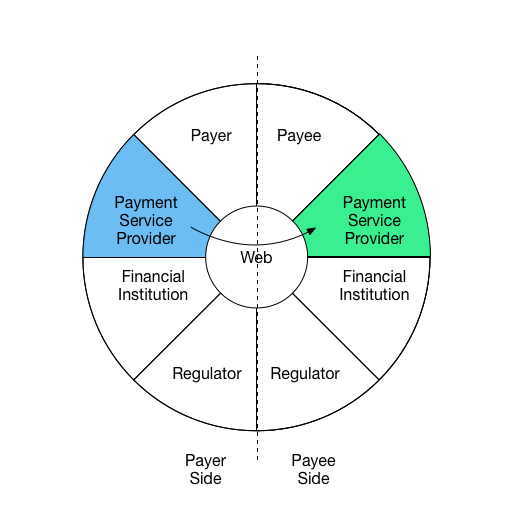

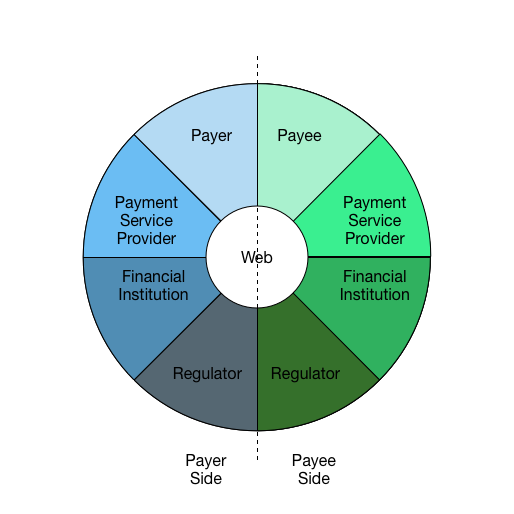

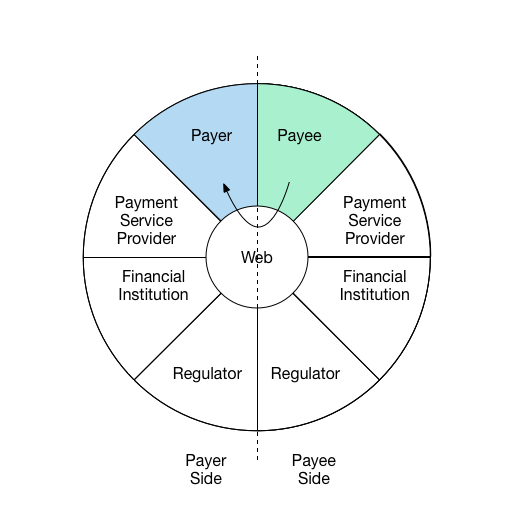

We will be overhauling this section to move into Key principles section and simplify the intent of the interaction wheel - namely the key principle that activities related to payments and adjacent domains may take place asynchronously over an extended time horizon and that required standards may be best expressed as a discrete interactions between 2 parties which can be recombined to express larger payments "flows" or multi-step scenarios.

To simplify and harmonize the descriptions of capabilities necessary for

payments and value exchange on the Web, it is helpful to understand the

parties involved and the direction that information flows among them at

various

phases of a payment. We use the following diagram to help illustrate

roles and information flow:

Figure: Payment Interaction Wheel

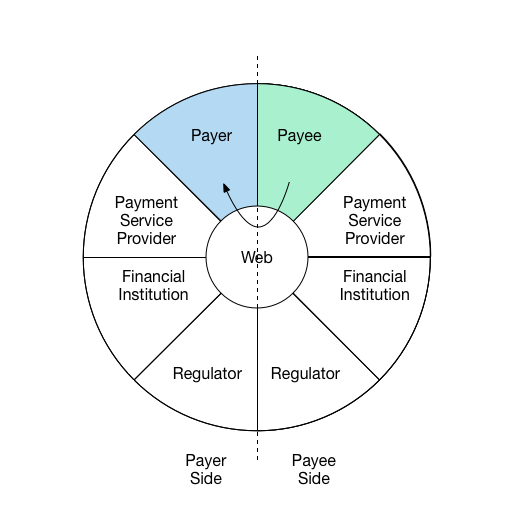

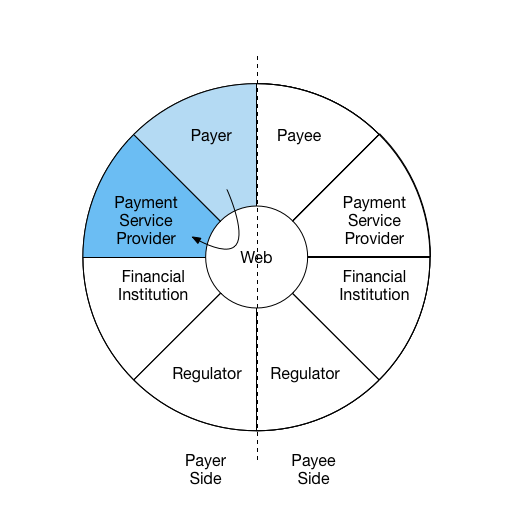

For example, the following diagrams illustrate three interactions in a

comment payment scenario.

Interaction 1:

Payee communicates request for payment to payer and shares

payment instructions

Interaction 2:

Payer uses information received from Payee and creates a

new payment request from payment service provider with stored

value.

Interaction 3:

Payer's payment service provider sends

details to complete payment to Payee's payment

service provider

The roles illustrated here may be carried out by many different

entities. For example, "account provider" may be carried out by

financial institutions, mobile operators, tech companies, or

cryptocurrency systems; 'payee' may be an individual, a business,

an NGO, or any entity that can accept a payment.

A payment may involve just two parties (e.g., peer-to-peer) or may be

carried out by several collaborating parties. For instance, apayee may use a payment service provider which in turn uses a

card network. The actions of these intermediaries may vary, from simply

forwarding messages to fulfilling regulatory obligations. Additionally,

these interactions may happen in different sequences and direction

depending on the payment context.

Capabilities in Detail

Core and Security

-

Key Management

-

All participants require an interchangeable mechanism for

creation, management, storage, and exchange of cryptographic keys

-

Key management capabilities are required to:

-

Securely communicate unique identifiers of payment process

participants

-

Digitally sign and authenticate information exchanged as

part of the payments process (e.g., payments, receipts,

invoices, etc.)

-

Provide reference key for independent elements of the

payments process to compose/link transactions and related data

across asynchronous segments of the payment process

-

Cryptographic Signatures

-

Information transferred should be cryptographically signed to

ensure

-

Authenticity of the participants and ownership of

value/asset being transferred or exchanged

-

Nonrepudiationof participants intent related to information

/ communication being exchanged

Key Concepts:

(describe any key concepts/relationship to other capabilities here)

Suggested Deliverables:

-

Data model with a concrete syntax for expressing data in the

architecture

-

Web-based key public key infrastructure data formats and protocols

-

New normalization mechanisms for data model serialization (if

necessary, for digital signatures)

-

Digital signature mechanism for data model

Related Specifications:

-

Data models: Graph (RDF), Document/Tree (JSON, XML)

-

Syntaxes: XML, JSON, JSON-LD

-

Normalization: XML Canonicalization, RDF Dataset Normalization

-

Signatures: Linked Data Signatures, Javascript Object Signing and

Encryption, XML Digital Signature

Responsible Working Group(s) or Standards Bodies:

-

Linked Data Signatures Working Group (W3C)

-

JOSE (IETF)

Identity and Credentials

The word identity means different things to different people

and is often discussed as a problem waiting to be solved on the Web. In

the physical world, we have many identities. We have an identity for

work life and home life. We have an identity that we use when we talk

with our friends and one that we use when we talk with our families. The

concept of identity is as nuanced as it is broad.

There are aspects of our identities that have very little consequence

to others, such as whether we have dark brown hair or black hair. There

are also aspects of our identities that are vital for proving that we

should be able to perform certain tasks, like a drivers license or

a medical board certification. Then there are aspects of our identities

that are important for social reasons, such as the rapport that we build

with our friends over our lifetimes.

Many aspects of our identity are often expressed via

credentials, which can be seen as verifiable statements made by

one person or organization about another. There have been multiple

attempts at formalizing credentials on the Web; each one of them have

been met with varying degrees of mild success, but mostly failure. The

rest of this section focuses on the goals of a healthy identity and

credentialing ecosystem as well as capabilities that would enable such

and ecosystem to thrive.

Goals

A healthy credentialing ecosystem should have a number of

qualities:

- Credentials should be

interoperable and portable. Credentials should be

used by as broad of a range of organizations as possible. The

recipient of a credential should be able to store, manage, and share

credentials throughout their lifetime with relative ease.

- The ecosystem should scale to the 3

billion people using the Web today and then to the 6 billion

people that will be using the Web by the year 2020.

- The process of exchanging a credential should be

privacy enhancing and recipient

controlled such that the system protects the privacy of the

individual or organization using the credential by placing the

recipient in control of who is allowed to access their

credential.

- Implementing systems that issue and

consume credentials should be easy for Web developers

in order to lower barriers to entry and increase the amount of

software solutions in the ecosystem.

- Creating systems that are

accessible should be a fundamental design criteria,

as 10% of the world’s population have disabilities and the solution

should be usable by as many people as possible.

- The solution should follow a number of core Web

principles such as being patent and royalty-free,

adhering to Web architecture fundamentals, supporting network

and device independence, and being

machine-readable where possible to enable

automation and engagement of non-human actors.

Capabilities

-

Identity

-

Entities in the System are able to access Identity information

of other parties it is interacting with if specifically required by

law, or if consented to by owner of the information

-

Identity and credentials of an entity are able to be

linked/associated with Accounts and payments to satisfy requirements

for Account Providers and

Payments Service Providers

to comply with KYC/AML requirements.

-

Credentials

-

Entities in the system are able to be associated with 1 or more

credentials. A credential is a qualification, achievement, quality,

or piece of information about an entity's background such as a name,

home address, government ID, professional license, or university

degree, typically used to indicate suitability. This allows for the

exchange of suitable qualities of the entity (ex. over age 21)

without divulging sensitive attributes/details about the entity (ex.

date of birth)

-

Payer is able to exchange standard format credentials withPayee

to validate attributes necessary to complete the payment

-

Entities in the system may store a credential at an arbitrary identity

provider after it has been issued by an arbitrary issuer. This helps create a

level playing field for all actors in the ecosystem.

-

A protocol for migrating from one identity provider to another without

the need to reissue each credential. This promotes a healthy identity

provider ecosystem.

-

Data Model

-

The data model should be extensible such that it supports an entity making

an unbounded set of claims about another entity. This enables a very

broad applicability of credentials to different use cases and market verticals.

-

The data model should be capable of being expressed in a variety of data

syntaxes. This increases interoperability between disparate credentialing

systems and increases the long-term viability of the technology.

-

A formal mechanism of expressing new types of claims without

centralized coordination. This promotes a high degree of parallel

adoption and innovation.

-

Rights

-

An entity should be able to express what "allowable use" of a credential

is when providing it to another entity such that there is recourse if a

credential is misused. For example, when providing an email address credential

an assertion is made such that the email address cannot be used as a

destination for marketing material.

-

Authentication

-

Participants are able to authenticate the validity of

identifiers presented by entities that they are interacting with

-

A digital signature mechanism that does not require out-of-band information to

verify the authenticity of claims; instead it should enable public

keys to be automatically fetched via the Web during verification. It

should not render the signed data opaque because opaque data is harder

to learn from, program to, and debug. This makes the digital signature

mechanism easier to use for developers and system integrators.

-

An issuer should be able to revoke a previously issued credential. This

enables issuers to ensure that the credentials they have issued

accurately represent their claims throughout the lifetime of the credential.

-

Authorization

-

Entities may use credentials to get access to protected resources or get

approval to perform protected tasks.

-

Privacy

-

All capabilities in this document should be standardized in a

way that minimizes the inclusion/exchange of personal or other

sensitive metadata that are part of the payments process unless

specifically required by law, or consented to by the owner of the

information.

-

A protocol that enables the recipient to share their credentials without

revealing the intended destination to their identity provider. This

enhances privacy.

-

Discovery

-

Payer is able to securely locate public identifier ofPayee to be used as part of payment process

-

Payee is able to obtain public identifier of Payer

participating in payment process

-

Payer identifier is persistent across devices

-

Registration

-

Payer and Payee able to register with payment

service provider to obtain credentials used for payments

process

-

Enrollment

-

Payment service provider is able to perform the necessary steps

during payer/payee enrollment to collect required identity

and credential information about the payer/payee and

associate it with an Account.

-

Regulatory and Legal

-

Entities should be able to detect when the collection of particular data

would violate personally identifiable information regulations. For example,

collecting the name and home address of a minor should be detectable and

avoided in jurisdictions where that is not allowed.

-

Entities should be able to easily request credentials and prove that they

performed the required regulatory checks before allowing a transaction

to complete. Ideally, this process should be automated.

Key Concepts:

TO DISCUSS: Trust Agent???

Suggested Deliverables:

-

Data format and vocabularies for expressing cryptographically

verifiable credentials

-

Protocol to issue credentials to a recipient

-

Protocol to store credentials at an arbitrary location as decided by

a recipient

-

Protocol to request and transmit credentials, given a recipient's

authorization, to a credential consumer

-

Protocol to strongly bind an identifier to a real world identity and

a cryptographic token (ex: two-factor hardware device)

-

Protocol to request and deliver untraceable, short-lived, privacy

enhancing credentials.

-

Protocol to discover entity's credential service

Related Specifications:

-

SAML (OASIS)

-

OpenID Connect (IETF)

-

Identity Credentials (Credentials WG)

-

Credentials Vocabulary (Credentials WG)

Responsible Working Group(s) or Standards Bodies:

-

Credentials Working Group (W3C)

-

Authentication Working Groups (W3C)

Accounts and Ownership

Accounts

-

Manage Accounts

-

Payers and Payees

(account owners) require the capability to create accounts at an

account provider.

-

Payers and Payees

require the capability to authorise access to their accounts by

third parties such as Payment

service providers.

-

Payers, Payees and other

authorised entities require the capability of checking the current

balance on an account.

-

Account Registration/Enrollmentat Payments service providers

-

Payers and Payees are

able to register accounts that will be used as part of the payment

process with Payment Services

Providers of their choice

-

Payers and Payees are

able to delegate access to specific account functions to Payment service providers of

their choice

-

Receive Funds

-

Payees are able to receive funds into

theiraccounts

-

Send funds

-

Payers are able to transfer funds from their

accounts

Key Concepts:

(describe any key concepts/relationship to other capabilities here)

Suggested Deliverables:

(include suggested/needed deliverables here)

Responsible Working Group(s) or Standards Bodies:

Related Specifications:

(Insert relevant related existing or in progress standards for

capability segment)

Ledgers

-

Discovery of Ledger services

-

Participants require the capability to locate the endpoints at

which ledger services are offered by an account provider

-

Participants require the capability to discover which services

are available against a ledger at an account provider

-

Capture transactions in ledger

-

Participants in the settlement process require the capability to

capture a transaction in a ledger transferring value from one

account to another on the same ledger.

-

Monitor a ledger

-

Participants in the settlement process require the ability

to monitor a ledger for new transactions that impact a specific

account.

-

Reserve funds in an account

-

To execute settlement across ledgers a counterparty may require

the ability to request that an account provider temporarily reserve

funds in an account while settlement is finalised on the other

ledger(s).

Key Concepts:

TODO

Suggested Deliverables:

-

Standardised data model for accounts and ledgers

-

Standardised interface for account management

-

Standardised interface for ledger services

-

Protocol for discovering ledger services

-

Protocol for executing settlement between participants on the open

Web

Related Specifications:

-

ISO20022 / X9 specs

-

Web Commerce Formats and Protocols (Web Payments WG)

-

Web Payments Vocabulary (Web Payments WG)

Responsible Working Group(s) or Standards Bodies:

-

Web Settlement Working Group (W3C)

Clearing and Settlement

-

Payment Instrument Discovery and Selection

-

Payer and payee are able to discover payment

instruments/schemes which they have in common and may be used in

the payment process

-

Payer is able to establish the different costs of making

the payment using the various combinations of payer andpayee instruments and schemes (payment methods)

-

Payer is able to select payment instrument for use in the

payment process

-

Payee is able to communicate requirements(or preference) to

payer as to whether a specific instrument is accepted and

the payment terms for using that instrument

-

Payment Initiation

-

Payer is able to initiate a payment using selected payment

instrument

-

Payer is able to identify Payee via:

-

Information received via Invoice

-

Individual contact information

-

Information from past payees

-

Payee is able to initiate a request for payment to payee's

designated account provider

-

Account provider is able to initiate a payment on behalf of the

Payee based on Payee's requested schedule and frequency (recurring

payment)

-

Payment Authorization

-

Payment service provider or payee is able to get

authorization from payer to execute payment either in real-time or

using a preloaded authorization mechanism

-

Payment service provider is able to demonstrate to payer

account provider that payment is authorised

-

Payment Execution

-

Payment orchestrator is able to evaluate that all requirements

have been met to execute the payment including authorization(s) and

compliance checks as required.

-

Payment orchestrator is able to instruct all participants to

execute the payment and perform any roll-back steps that may be

required in case of a failure by any participant to complete the

payment.

-

Payment Acknowledgement

-

Payee is able to receive confirmation that payment has been

successfully completed

-

Payer is able to receive verification that payment has been

successfully received

-

Account provider is able to receive confirmation that payment is

complete

-

Regulatory/Legal Compliance

-

Regulator is able to access/view required payment, payer,

and payee details for payments that take place within their

jurisdiction

-

Regulator is able to intervene in payments meeting or

exceeding certain thresholds or criteria in order to comply with

jurisdictional laws and requirements

-

Payment Settlement and Clearing

-

Payment service provider is able to provide payer with

quotesto settle payee via all payee supported payment

schemes

Key Concepts:

TODO: Payment Agent

Suggested Deliverables:

-

Protocol for discovering all payment instruments available to a

payer.

-

User Agent API and REST API for initiating a payment and protocol

for routing an invoice to a payment service

-

Protocol for authorizing payment via regulatory API

-

User Agent API and REST API for completing a payment and protocol

for routing payment acknowledgement to payer

Related Specifications:

-

ISO20022 / X9 specs

-

Web Commerce Formats and Protocols (Web Payments WG)

-

Web Commerce User Agent API (Web Payments WG)

-

Web Payments Vocabulary (Web Payments WG)

Responsible Working Group(s) or Standards Bodies:

-

Web Payments Working Group (W3C)

Commerce

Offers

-

Generate Offer

-

Payee is able to generate a standard format offer which

provides information on specific products or services being

offered, and additional information on payment instruments

accepted, or terms of the offer.

-

Payer is able to generate a standard format offer which can

be accepted or declined by the payee.

-

Payee is able to create scheduled/recurring offers

-

Receive Offer

-

Payer is able to receive offer in machine readable format

and use it to initiate payment request

-

Payeeis able to receive offer in machine readable format and use

it to create invoice

Discounts

-

Payee is able toable tocommunicate discounts which may be

applied to Offers

-

Payee is able to receive and apply discount to offer

-

Payee is able to apply standard loyalty identifiers to offers

Coupons

-

Payer is able to apply coupons to offers

-

Payee is able to issue general use coupons

-

Payee is able to issue coupons specific to payer

identifier

Key Concepts:

Suggested Deliverables:

-

Data format and vocabularies for expressing offers and coupons

-

User Agent API for using an offer to initiate a payment

Related Specifications:

-

Web Commerce Formats and Protocols (Web Payments WG)

-

Web Commerce User Agent API (Web Payments WG)

-

Web Payments Vocabulary (Web Payments WG)

Responsible Working Group(s) or Standards Bodies:

-

Web Payments Working Group (W3C)

Invoices

-

Invoice creation

-

Payee is able to generate a standard formatted invoice and

communicate to Payer as part of the negotiation of payment

terms

-

Invoice receipt

-

Payer is able to receive standard formatted invoice

-

Invoice data

-

Invoice provides payer with Payment instructions for

making payment to Payee

-

Invoice identifier is returned to Payee via payment

process to verify payment is complete

Key Concepts:

Suggested Deliverables:

-

Data format and vocabulary for expressing an invoice

-

User Agent API for initiating a payment and protocol for routing an

invoice to a payment service

Related Specifications:

-

Web Commerce Formats and Protocols (Web Payments WG)

-

Web Commerce User Agent API (Web Payments WG)

-

Web Payments Vocabulary (Web Payments WG)

Responsible Working Group(s) or Standards Bodies:

-

Web Payments Working Group (W3C)

Receipts

-

Create Receipt

-

Payee is able to create receipt and communicate receipt to

Payer following completion of payment

-

Receive Receipt

-

Payer is able to receive receipt and persist for future use

(ex. returns, reimbursement, etc)

Key Concepts:

Suggested Deliverables:

-

Data format and vocabulary for expressing a receipt

-

Protocol for routing an receipt to a payer's receipt storage service

Related Specifications:

-

Web Commerce Formats and Protocols (Web Payments WG)

-

Web Payments Vocabulary (Web Payments WG)

Responsible Working Group(s) or Standards Bodies:

-

Web Payments Working Group (W3C)

Loyalty

-

Payer is able to register with Payee's loyalty program by

requesting loyalty identifier from Payee.

-

Payee can 'opt-in' to loyalty program by providing program

specific public identifier

Key Concepts:

Suggested Deliverables:

-

Same as 'Trust' deliverables

Related Specifications:

-

Identity Credentials (Credentials WG)

-

Credentials Vocabulary (Credentials WG)

-

Web Commerce Vocabulary (Credentials WG)

Responsible Working Group(s) or Standards Bodies:

-

Credentials Working Group (W3C)